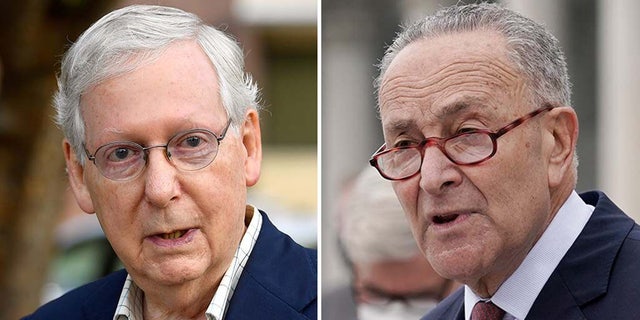

NEW Fox News articles can now be heard on audio! Sen. Joe Manchin and Senate Majority Leader Chuck Schumer announced an agreement on a drastically reduced reconciliation package on Wednesday, following more than a year of “Build Back Better” discussions.

The package’s $433 billion in expenditure is less than one-sixth of the massive $3 trillion bill that Democrats were debating at this time last year. Democrats claim that while having many fewer provisions, it will still generate $739 billion in tax revenue.

Using the bill’s new name, Schumer, D-N.Y., and Manchin, D-W.Va., released a joint statement on Wednesday. “The Inflation Reduction Act of 2022 will make a historic down payment on deficit reduction to fight inflation, invest in domestic energy production and manufacturing, and reduce carbon emissions by approximately 40% by 2030,” they said.

The law, they continued, “would finally let Medicare to bargain for prescription medications and reduce healthcare expenses for millions of Americans.”

MANCHIN AND SCHUMER AGREE TO BUILD BACK BETTER’S MASSIVELY PARED-BACK VERSION

Democrats previously consented to bill measures that aim to reduce the cost of prescription pharmaceuticals and extend some components of the Affordable Care Act (ACA), popularly known as ObamaCare.

The agreement would permit Medicare to bargain for lower prescription medication prices and would extend the ACA through 2025, according to a summary of the measure published on Wednesday. Democrats claim that the prescription medication reform would save the government $288 billion while the ACA extension would cost $64 billion.

Democrats were previously stuck on the tax, energy, and environment proposals until Wednesday. Manchin, who hails from a state that produces energy, frequently disagrees with his own party over climate policy. The moderate senator also frequently emphasized that Congress must take care to ensure that whatever economic policies it undertakes would not have a negative impact on the economy or inflation.

After Manchin and Schumer agreed to a reconciliation agreement, House Republicans moved to reject the China Competition Bill.

The Manchin-Schumer package, however, would invest a total of $369 billion in energy and climate change initiatives, according to the bill summary. It also contains a $1 billion corporate minimum tax at 15%, increased IRS tax enforcement at $124 billion, and the closing of the carried interest loophole at $14 billion, all of which are expected to raise a combined $313 billion.

Republicans will undoubtedly reject several of the renewable energy and environmental elements of the package in addition to complaining about tax increases. One of them is for a “Neighborhood access and equity award program,” which will cost close to $1.9 billion. The funds would be made available, among other things, to improve impoverished communities’ “gaps in tree canopy coverage.”

Another clause in the bill will allocate $1.5 billion “for tree planted and related activities, with a preference for projects that help underprivileged populations and areas.”

The law also includes a provision that allocates $403 million for IRS expenses, “including purchase and hiring of passenger motor vehicles.”

Additionally, it would offer up to a $7,500 tax credit to households earning up to $300,000 a year for electric vehicles built outside of unfriendly countries and without the use of essential minerals from those nations.

Up to $80,000 in new vans, SUVs, and trucks are eligible for the tax credit. The ceiling for other vehicles is $55,000.

Also available is a $4,000 tax credit for used electric automobiles for families earning up to $150,000.